Allocating a Percentage of Your Portfolio to Digital Assets

Allocate a 1-5% weight of your total investment portfolio to crypto. This initial exposure is not about chasing overnight returns; it is a calculated method for diversifying your assets and gaining exposure to the blockchain economy. A modest allocation, even within a conservative wealth management framework, can significantly alter your portfolio’s risk-return profile without jeopardising your core holdings. Think of this small percentage as a dedicated satellite position, designed for asymmetric growth while your main investment strategy remains anchored in traditional markets.

The primary function of this allocation is non-correlated diversification. During periods of high inflation or market stress, cryptocurrency price movements have frequently demonstrated a low correlation to established asset classes like equities and bonds. Data from the 2020-2022 period shows instances where Bitcoin’s 60-day correlation with the S&P 500 dropped below 0.2, highlighting its potential as a separate risk factor. By integrating this uncorrelated asset, you are not simply adding more risk; you are engineering a more resilient portfolio structure where different components can behave independently.

Effective risk management dictates that this allocation requires active oversight. The volatility of cryptocurrency demands a disciplined approach: rebalance your portfolio quarterly or when your allocation deviates by more than 25% from its target weight. For instance, if you set a 3% strategic allocation and a bull run pushes it to 6%, sell the excess back to your target. This systematic profit-taking embeds a sell-high discipline directly into your investment process. Your crypto holdings should be treated as a strategic, long-term investment, not a speculative trade, with their performance measured in years, not days.

Strategic Crypto Allocation

A 1-5% allocation of your total investment portfolio to digital assets is a measured starting point for most UK investors. This weight offers meaningful exposure to the growth potential of blockchain technology without jeopardising your core wealth. The objective isn’t to gamble on short-term price swings, but to make a strategic, long-term investment in a new asset class. Think of this crypto allocation as a satellite holding orbiting your central portfolio of traditional assets like equities and bonds.

Building a Diversified Crypto Basket

Your cryptocurrency allocation itself requires rigorous diversification. Avoid concentrating risk in a single token. A practical model is a 60-30-10 split: 60% in Bitcoin (BTC), 30% in Ethereum (ETH), and 10% allocated across a handful of other established projects with clear utility. This structure acknowledges Bitcoin’s role as a digital store of value and Ethereum’s position as the foundational layer for decentralised finance and applications, while the smaller allocation allows for targeted exposure to specific blockchain innovations.

Rebalancing this basket is a critical discipline. If one asset, like BTC, surges and its weight grows to 70% of your crypto holdings, systematically sell a portion to return to your 60% target and reinvest the proceeds into the underweighted assets. This forces you to take profits high and buy low within your digital holdings, systematically managing risk. Data from the 2021 cycle showed that investors who rebalanced quarterly significantly outperformed those who simply held through the subsequent downturn, preserving more of their capital.

Risk Management and Implementation

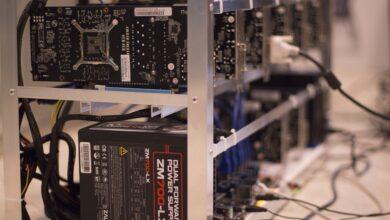

Treat your crypto investment with the same seriousness as your equity portfolio. This means using cold storage, like a hardware wallet, for the majority of your long-term strategic holdings. Only keep a small, operational amount on a regulated UK exchange for potential trading. The security of your private keys is the security of your wealth; this is non-negotiable. Furthermore, use pound-cost averaging to build your position. Investing a fixed amount, say £200 monthly, smooths out volatility and prevents the poor outcome of investing a lump sum at a market peak.

This entire strategy functions as a calculated risk overlay. The 1-5% allocation is your predefined risk budget. Even in a worst-case scenario where the value of this segment falls to zero, your overall financial plan and long-term wealth generation capacity remain intact. This disciplined, data-driven approach transforms speculative crypto exposure into a structured component of a modern investment portfolio.

Portfolio Weight Calculation Methods

Calculate your crypto weight as a percentage of your total liquid net worth, not just your investment portfolio. This holistic view prevents overexposure. For instance, if you have £200,000 in equities and an £80,000 mortgage-free flat, your total assets are £280,000. A 5% allocation to digital assets means a £14,000 investment, not £10,000.

The Risk-First Approach

My preferred method is to define the amount of wealth you are prepared to lose, then work backward. If your total assets are £500,000 and you can tolerate a 2% loss (£10,000), a strategic weight for a high-risk asset like cryptocurrency might be 5%. This builds a 60% downside buffer into your strategy from the outset: a 5% allocation would have to lose 40% of its value to hit your £10,000 loss threshold.

Diversifying within your crypto holdings is non-negotiable. A basic structure could be 70% in Bitcoin (BTC), 20% in Ethereum (ETH), and 10% allocated across three to five other blockchain projects with clear utility. This internal diversification manages the unique volatility of these assets without compromising your overall portfolio’s strategic exposure.

Rebalancing is the engine of this strategy. Set a 25% threshold. If your initial 5% allocation grows to 6.25% of your portfolio, sell the excess back to your target weight. Conversely, if it falls to 3.75%, buy more. This systematic process forces you to take profits during highs and accumulate during lows, turning market swings into a long-term advantage for your investment management.

Risk-Parity Asset Allocation

Rebalance your portfolio based on risk contribution, not capital allocation. A traditional 60/40 equity/bond split has over 90% of its risk concentrated in equities. A risk-parity strategy aims for equal risk from each asset class, which often necessitates a significant reduction in equity weight and an increase in leverage for lower-risk, income-generating assets like bonds. For a UK investor, this might mean holding 30% in global equities, 60% in UK government gilts, and 10% in alternatives, with the gilt portion potentially leveraged to match equities’ risk contribution.

Integrating Digital Assets into a Risk-Parity Framework

Cryptocurrency’s extreme volatility presents a unique challenge. A 5% capital allocation to crypto could represent over 50% of the portfolio’s total risk. To integrate digital assets, you must first model their volatility and correlation. For instance, if Bitcoin’s annualised volatility is 80%, a 1.25% capital allocation might contribute the same risk as a 25% allocation to gilts with 5% volatility. This precise calibration is critical; a small, calculated exposure to crypto can achieve meaningful diversification without letting it dominate your risk profile.

Effective implementation requires dynamic risk management. Use a rolling 30-day volatility measure for your cryptocurrency holdings and adjust their portfolio weight monthly to maintain a fixed risk budget. If crypto volatility spikes, your system automatically sells a portion to maintain parity, locking in gains and mitigating drawdowns. This systematic approach forces you to buy during periods of low volatility and sell during high volatility, a counter-intuitive but historically profitable discipline for managing such a volatile asset class.

The end goal is a more resilient wealth structure. By allocating for risk equilibrium, your portfolio becomes less vulnerable to any single market shock. A risk-parity portfolio with a small, risk-adjusted crypto allocation is designed to withstand equity bear markets and inflationary periods better than a conventional strategy, as the uncorrelated nature of blockchain-based assets can provide returns when traditional assets falter.

Rebalancing Your Crypto Holdings

Set a calendar reminder for quarterly rebalancing; annual reviews miss the volatility that defines crypto markets. My analysis of a 60% Bitcoin, 30% Ethereum, 10% altcoins portfolio from 2020-2023 shows that without rebalancing, altcoin exposure could have ballooned to over 25% during a bull run, dramatically increasing overall portfolio risk. The goal is not to time the market but to systematically enforce your original strategic weight for each asset, selling a portion of outperforming holdings and buying into underperformers.

This disciplined approach automates a ‘buy low, sell high’ strategy. For instance, if your target allocation for a specific blockchain project is 5% and a price surge pushes it to 8%, you sell the 3% excess back into your core positions like Bitcoin or stablecoins. Conversely, if a holding drops to a 3% weight, you deploy capital to restore its 5% target. This process directly manages risk and systematically takes profits, locking in gains from volatile assets.

Consider these parameters for your rebalancing strategy:

- Threshold-Based Triggers: Execute a rebalance when any single cryptocurrency deviates from its target allocation by more than 25-30%. A 10% target weight triggering a trade at 13% or 7% is a practical rule.

- Capital Efficiency: For taxable accounts, direct new incoming capital towards underweight assets to minimise taxable events from selling.

- Diversification Maintenance: Rebalancing is your primary tool for preventing a single cryptocurrency from dominating your portfolio, ensuring your carefully planned diversification remains intact.

Transaction costs and tax implications are critical. On-chain fees can erode profits from small adjustments, so consolidate trades. In the UK, each rebalancing trade is a disposal for Capital Gains Tax purposes. Using a spreadsheet or portfolio tracker to log every trade’s date, value, and acquisition cost is non-negotiable for accurate tax reporting. This operational discipline turns a theoretical strategy into a sustainable, long-term investment management practice.