Essential Tools for Smart Crypto Investing

The cryptocurrency market, with its dizzying array of assets and rapid fluctuations, presents both challenges and opportunities for savvy investors and traders. In this digital age, where information travels at the speed of light, understanding the underlying patterns and trends becomes paramount for anyone looking to navigate this volatile landscape. By carefully studying market movements, investors can glean insights that not only facilitate informed decision-making but also enhance the potential for profitable outcomes.

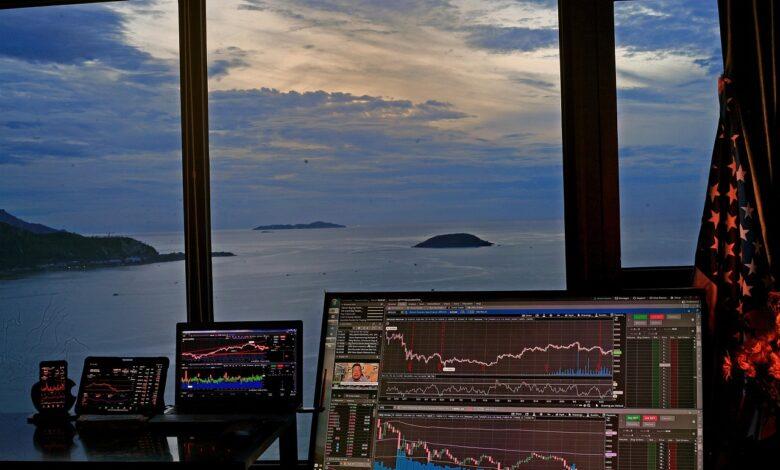

To effectively engage with the ever-evolving dynamics of the cryptocurrency market, one must possess a suite of essential tools. These resources, ranging from analytical software to real-time data feeds, serve as key instruments in evaluating market conditions. As we delve deeper into the intricacies of crypto assets, it becomes increasingly clear that those who embrace these analytical tools will be better equipped to assess trends and identify opportunities that others may overlook.

In our exploration of analyzing market trends and patterns, we will highlight must-have resources that every cryptocurrency trader should consider integrating into their toolkit. By leveraging these instruments, investors can move beyond mere speculation, adopting a more methodical approach to trading that is rooted in data-driven analysis. Ultimately, this pursuit of knowledge and understanding not only enriches one’s own investment strategy but also contributes to the broader conversation surrounding the future of digital assets.

Analyzing Market Trends in Crypto: Essential Tools for Investors

In the rapidly evolving landscape of cryptocurrency, understanding market trends is paramount for any serious investor. The digital asset space is characterized by its volatility, making it crucial for investors to equip themselves with key instruments that enable effective analysis. By studying market movements and identifying patterns, crypto traders can make informed decisions, ultimately enhancing their investment strategies. This analytical approach not only helps in mitigating risks but also positions investors to capitalize on potential opportunities.

When evaluating market dynamics, the first essential tool at an investor’s disposal is technical analysis software. These platforms provide comprehensive charts and indicators that allow traders to assess price movements over time. By analyzing historical data, investors can identify trends and forecast future price actions. Tools such as Moving Averages, Relative Strength Index (RSI), and Fibonacci retracement levels serve as critical instruments that aid in this process. For instance, a trader might observe a bullish pattern forming after prolonged bearish movements, signaling a potential buying opportunity.

Additionally, fundamental analysis remains a must-have resource for discerning investors. This involves assessing the underlying factors that influence the value of a cryptocurrency, such as its use case, the team behind the project, and market sentiment. By keeping abreast of news developments and regulatory changes, traders can evaluate how these dynamics affect market patterns. For example, an announcement of institutional investment can lead to significant upward movements in a digital asset’s price, prompting astute investors to adjust their portfolios accordingly.

In conjunction with technical and fundamental analyses, sentiment analysis has emerged as a vital instrument for crypto traders. By utilizing social media monitoring tools and sentiment trackers, investors can gauge public perception regarding specific cryptocurrencies. Understanding market sentiment is crucial; it often drives short-term price fluctuations that technical indicators may not immediately capture. For example, a sudden surge in positive tweets about a particular altcoin could indicate an impending price rally, thereby influencing trading decisions.

Moreover, data analytics platforms have become indispensable resources for those assessing cryptocurrency markets. These tools aggregate vast amounts of data from various exchanges and wallet addresses, providing insights into trading volumes and liquidity. By studying these metrics, investors can identify patterns that signal market strength or weakness. For instance, a spike in trading volume accompanied by rising prices may indicate strong buyer interest, while low volumes might suggest caution among traders.

Ultimately, successfully navigating the complexities of the cryptocurrency market requires a multifaceted approach to analyzing trends. By employing a combination of technical analysis tools, fundamental insights, sentiment evaluations, and robust data analytics resources, investors can develop a comprehensive understanding of market dynamics. This analytical rigor not only informs better trading decisions but also fosters confidence in an inherently unpredictable environment–an essential quality for anyone looking to thrive in the world of digital assets.

Essential Tools for Crypto Investors

In the rapidly evolving landscape of cryptocurrency, understanding market trends is crucial for investors aiming to navigate the complexities of digital assets. The first essential tool every crypto investor should employ is data analytics platforms. These resources enable traders to visualize price movements and trading volumes effectively. By studying these dynamics, investors can identify key patterns that precede significant market shifts. For instance, platforms like CoinMarketCap and TradingView offer interactive charts, allowing users to analyze historical data and forecast potential future movements.

Another vital instrument in the arsenal of a cryptocurrency trader is sentiment analysis tools. These resources assess the emotional tone of social media, news articles, and public forums surrounding specific cryptocurrencies. By evaluating these sentiments, investors can gauge the market’s mood and anticipate possible price fluctuations. For example, a surge in positive sentiment towards a particular asset may signal impending upward movements, while negative sentiment might indicate a potential downturn.

Moreover, fundamental analysis remains an indispensable technique for assessing market dynamics. This approach involves scrutinizing various factors such as project viability, team credentials, and technological advancements behind a cryptocurrency. Resources like Messari provide in-depth reports and metrics that help investors determine the intrinsic value of an asset. Understanding these fundamentals allows traders to make informed decisions rather than relying solely on superficial market trends.

Technical analysis is another essential component for crypto investors looking to refine their strategies. Utilizing indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands helps traders evaluate market patterns and predict future price movements. By employing these analytical tools, investors can establish entry and exit points with greater precision, thereby enhancing their overall trading performance.

In addition to the aforementioned tools, risk management resources are critical for maintaining a balanced investment portfolio. Stop-loss orders and position sizing calculators are fundamental instruments that help traders mitigate potential losses during volatile market conditions. By incorporating these strategies into their trading plans, investors can protect their assets from sudden downturns while still capitalizing on upward trends.

Finally, one cannot overlook the importance of community-driven platforms such as Reddit and Discord channels. These forums provide invaluable insights from fellow investors who share their experiences and analyses of market movements. Engaging with these communities allows traders to stay updated on emerging trends and gather diverse perspectives on various cryptocurrencies. In conclusion, utilizing a combination of analytical tools, sentiment assessments, fundamental evaluations, technical indicators, risk management strategies, and community insights equips crypto investors with a comprehensive toolkit necessary for navigating the intricate world of digital assets.

Understanding Market Indicators for Crypto Investors

In the ever-evolving landscape of cryptocurrency, understanding market indicators is paramount for investors seeking to navigate the tumultuous waves of digital asset movements. Market indicators serve as essential tools that provide insights into the underlying dynamics of trading activities. These indicators, ranging from simple metrics like trading volume to more complex analyses such as Relative Strength Index (RSI) or Moving Averages, enable traders to assess market sentiment and identify potential trends. By analyzing these patterns, investors can make informed decisions that align with their investment strategies.

When it comes to assessing market patterns, a variety of must-have resources are at the disposal of cryptocurrency traders. Charting platforms such as TradingView or Coinigy offer sophisticated tools that allow users to visualize price movements and apply various technical analysis methods. Moreover, understanding candlestick patterns can significantly enhance one’s ability to interpret market dynamics effectively. For instance, recognizing bullish engulfing patterns may signal an impending upward trend, while bearish patterns might indicate a potential downturn. Thus, familiarizing oneself with these resources is vital for anyone serious about investing in the crypto space.

Studying market movements requires a keen awareness of both macroeconomic factors and specific asset performance. Key instruments like fundamental analysis–examining the underlying value propositions of cryptocurrencies–can complement technical analysis by providing context to price fluctuations. For example, news related to regulatory changes or technological advancements can have profound effects on a digital asset’s valuation. Consequently, investors should remain vigilant and incorporate diverse analytical approaches to fully appreciate the complexities of market dynamics.

Evaluating market dynamics is not merely about observing current trends; it also involves anticipating future movements based on established data and evolving conditions. Essential tools such as sentiment analysis platforms, which aggregate social media discussions and news articles, can provide valuable insights into public perception and investor behavior. By integrating these instruments into their investment processes, crypto investors can cultivate a more nuanced understanding of the marketplace. In this intricate dance of numbers and narratives, those who equip themselves with the right knowledge and tools will find themselves better positioned to thrive amidst the volatility that defines the world of cryptocurrency.

Conclusion: Navigating the Crypto Landscape with Precision

In the ever-evolving terrain of cryptocurrency, where market movements can change in the blink of an eye, the importance of robust data analytics cannot be overstated. For investors venturing into this digital frontier, understanding the dynamics of market trends is not merely a supplementary strategy; it is an essential framework for success. The tools available today empower traders to dissect and evaluate patterns that might otherwise remain obscured in the chaos of price fluctuations.

By employing key instruments designed for analyzing market behaviors, crypto investors can gain unprecedented insight into asset performance. These resources enable them to study not just historical data but also predictive analytics that shape future possibilities. As we conclude this exploration, let us summarize the essential techniques and methodologies that every digital asset trader should embrace:

- Technical Analysis: Utilizing charts and indicators to assess past price movements and predict future trends.

- Fundamental Analysis: Evaluating the intrinsic value of cryptocurrencies by examining technology, team, and market demand.

- Sentiment Analysis: Gauging market sentiment through social media and news outlets to anticipate trader behavior.

- On-Chain Analysis: Analyzing blockchain data to understand transactions and network activity, providing insights into market health.

As we navigate this labyrinth of digital assets, remember that success lies not only in acquiring knowledge but in applying these essential tools effectively. The ability to assess and evaluate market patterns transforms uncertainty into opportunity. With a heart full of passion for this dynamic landscape, let us venture forth–armed with insights, empowered by data, and ready to seize the opportunities that await in the world of cryptocurrency.