Mining Methods – Cloud vs. Hardware Unveiled

The world of cryptocurrency mining presents a fascinating dichotomy between cloud mining and hardware mining, each offering unique strengths and weaknesses. As digital currencies continue to rise in prominence, understanding the advantages and disadvantages of these two approaches becomes essential for both newcomers and seasoned investors alike. In this exploration, we shall delve into the nuances of remote mining versus on-site mining, while also discussing the critical distinctions between virtual mining and equipment-based mining.

At its core, cloud mining provides an alluring proposition: the ability to mine cryptocurrencies without the burden of physical hardware. This method offers significant benefits such as reduced energy costs and lower barriers to entry. However, it is not without its drawbacks. Issues surrounding trust, transparency, and potential scams have led many to question the reliability of cloud services. On the other hand, hardware mining allows for greater control and potentially higher returns, yet it requires substantial upfront investment in equipment and ongoing maintenance efforts.

As we analyze these various forms of mining, it becomes clear that each method harbors its own set of benefits and disadvantages. The remote nature of cloud mining appeals to those seeking simplicity, while on-site mining can provide a tangible connection to the process. Nevertheless, both options come with their respective challenges–whether it be managing physical equipment or navigating the complexities of service contracts in the cloud.

In this article, we will thoroughly review the pros and cons of each approach to provide a well-rounded perspective on cloud versus hardware mining. By dissecting the strengths and weaknesses inherent in each method, we aim to equip readers with the knowledge necessary to make informed decisions in their cryptocurrency ventures. Join us as we embark on this analytical journey through the multifaceted landscape of cryptocurrency mining.

Cloud Mining vs. Hardware Mining: Pros and Cons Explained

Cloud mining, a concept that has gained traction in recent years, allows users to mine cryptocurrencies remotely by renting mining power from data centers. This method eliminates the need for purchasing expensive equipment and managing its installation and maintenance. However, it is essential to discuss the disadvantages of cloud mining, particularly concerning the potential for scams and the lack of control over the mining process. Many cloud mining services operate with minimal transparency, making it difficult for users to assess their reliability and profitability.

In contrast, physical or hardware mining involves purchasing and operating your own mining equipment on-site. This traditional approach offers certain advantages, such as complete control over the hardware and the ability to optimize settings for maximum efficiency. Nevertheless, physical mining comes with notable drawbacks, including significant upfront costs, ongoing electricity expenses, and the technical know-how required for setup and maintenance. The constant evolution of mining technology can also render equipment obsolete quickly, leading to further financial implications.

When analyzing remote mining versus on-site mining, we encounter distinct benefits and drawbacks. Remote mining typically refers to cloud services that allow users to engage in cryptocurrency mining without setting up their own rigs. The primary strength of this model is convenience; users can participate in mining without having to deal with the complexities of hardware management. However, remote mining often lacks transparency regarding actual performance and payouts, which can be a significant disadvantage for investors seeking reliable returns.

On the other hand, on-site mining presents its own set of challenges and advantages. The most significant benefit of operating personal equipment is direct access to all aspects of the operation, from hardware performance to electricity consumption. However, this level of control comes with inherent weaknesses; miners must contend with issues like cooling requirements, noise pollution from running machines, and the inevitable risk of hardware failure. These factors can complicate what initially appears to be a straightforward investment.

Virtual mining solutions have emerged as an alternative to traditional equipment-based approaches. These platforms often leverage shared computing power or virtual machines to facilitate cryptocurrency extraction without requiring individual ownership of physical hardware. While this model can lower initial costs and eliminate some operational headaches, it is essential to review the potential weaknesses involved–such as reliance on third-party service providers who may not deliver promised results.

In summary, both cloud mining and hardware mining present unique advantages and disadvantages that warrant careful consideration before making a decision. Cloud mining appeals to those seeking convenience but carries risks related to transparency and control. Conversely, while physical mining provides autonomy and direct oversight of operations, it demands substantial investment and maintenance efforts. By analyzing these factors objectively, individuals can make informed choices that align with their financial goals and risk tolerance in the ever-evolving landscape of cryptocurrency mining.

Cloud Mining vs. Hardware Mining: A Comprehensive Analysis

In the ever-evolving landscape of cryptocurrency, the debate between cloud mining and hardware mining remains a focal point for enthusiasts and investors alike. Cloud mining, which allows users to rent hashing power from remote data centers, presents several advantages over traditional hardware mining. One of the primary strengths of cloud mining is its accessibility; individuals without technical expertise can participate in cryptocurrency mining without the need for costly equipment or in-depth knowledge of setup procedures. Additionally, cloud mining eliminates concerns about hardware maintenance and electricity costs, as these responsibilities are managed by the service provider.

However, it is essential to recognize the disadvantages associated with cloud mining. Users often face a lack of transparency regarding the actual performance and profitability of their investments. Moreover, many cloud mining contracts may impose hidden fees or unfavorable terms that can diminish potential returns. Thus, while cloud mining offers certain conveniences, it also presents risks that must be carefully considered before committing funds.

When comparing virtual mining to equipment mining, the strengths and weaknesses become even more pronounced. Equipment mining provides miners with full control over their operations, allowing for direct management of hardware settings and optimization strategies. This degree of control can lead to higher profitability when executed correctly. Conversely, the drawbacks of equipment mining include the significant upfront investment in physical hardware, ongoing maintenance costs, and the need for technical proficiency to troubleshoot issues that may arise.

The debate between remote mining and on-site mining further illustrates the complexities involved in choosing a mining approach. Remote mining offers the benefit of geographical flexibility; miners can operate without being tethered to a specific location. This is particularly advantageous for those living in areas with high electricity costs or restrictive regulations. However, relying on third-party services introduces vulnerabilities related to trust and reliability, as miners are ultimately dependent on external infrastructure.

Conversely, on-site mining provides a sense of security through direct ownership and operation of hardware. Miners can actively monitor their equipment and make immediate adjustments as needed to maximize efficiency. Nevertheless, this method entails several disadvantages such as space requirements, potential noise pollution, and heightened energy consumption that can offset any potential benefits.

In conclusion, both cloud mining and hardware-based approaches present unique advantages and disadvantages that must be thoroughly analyzed before making a decision. Each method possesses distinct strengths–whether it be the convenience of remote operations in cloud mining or the control afforded by physical equipment in on-site mining. As the cryptocurrency market continues to mature, understanding these dynamics will empower miners to choose an approach that aligns with their goals and resources while navigating the inherent risks involved in this volatile landscape.

Disadvantages of Cloud Mining

Cloud mining, while appealing for its accessibility, presents a series of notable disadvantages that warrant careful consideration. One of the most significant drawbacks is the lack of control over hardware and equipment. In contrast to physical mining, where miners can optimize their rigs for better performance, cloud mining users are reliant on third-party providers. This dependence can lead to inefficiencies and potential losses, especially if the provider fails to maintain or upgrade the mining equipment appropriately. Moreover, the risk of fraud is elevated in this model; many cloud mining services have been reported as scams, leaving investors with little recourse.

When discussing cloud mining vs. physical mining, one must weigh the advantages and disadvantages of each approach meticulously. While cloud mining offers convenience and lower upfront costs, physical mining allows for direct oversight of hardware and energy management. The benefits of owning your own equipment include the ability to troubleshoot issues firsthand and maximize profits by selecting optimal locations with lower electricity costs. On the other hand, physical mining requires significant initial investment and ongoing maintenance, which can be daunting for newcomers in the cryptocurrency space.

The debate between remote mining and on-site mining further elucidates the strengths and weaknesses inherent in each method. Remote mining through cloud services eliminates the need for physical space and technical know-how, allowing users to engage in cryptocurrency activities without the complexities of setup. However, this ease comes at a price–users often face hidden fees and fluctuating service reliability. In contrast, on-site mining provides tangible control over operations but also imposes challenges such as cooling requirements and physical security concerns.

Lastly, when we analyze virtual mining against equipment mining, we encounter distinct sets of pros and cons that can influence an individual’s decision-making process. Virtual mining platforms often promise high returns with minimal effort; however, these promises may mask underlying risks such as poor performance or sudden changes in contract terms. Equipment mining, meanwhile, allows for a hands-on approach where miners can directly influence their output by optimizing their setup and strategies. Nevertheless, it also demands a commitment to learning about hardware operation and constant vigilance regarding market conditions. In summary, whether one opts for cloud or hardware solutions in the realm of cryptocurrency mining largely depends on their individual risk tolerance and willingness to engage with the complexities of this evolving field.

Hardware Mining Overview

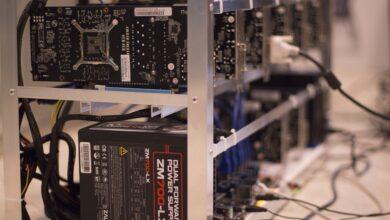

In the realm of cryptocurrency, hardware mining remains a cornerstone of the ecosystem. It involves the use of physical equipment, such as ASICs (Application-Specific Integrated Circuits) and GPUs (Graphics Processing Units), to solve complex mathematical problems that validate transactions on a blockchain. The strengths of hardware mining lie in its potential for higher returns, as miners with better equipment can achieve greater hashing power, thereby increasing their chances of earning rewards. However, these advantages come with significant weaknesses, including high initial costs for the hardware and ongoing expenses related to electricity consumption and cooling systems.

When we juxtapose virtual mining, often referred to as cloud mining, against traditional equipment mining, it becomes evident that each approach has its own set of strengths and weaknesses. Cloud mining allows individuals to rent processing power from remote data centers, eliminating the need for personal investment in hardware. This model offers convenience and lower entry barriers for newcomers to the cryptocurrency space. Conversely, equipment mining provides miners with greater control over their operations and the potential for substantial profit margins if managed effectively. Nevertheless, it also exposes them to risks such as equipment failure and fluctuating market conditions.

The discussion surrounding cloud mining versus physical mining reveals an array of advantages and disadvantages that merit careful consideration. Cloud mining can significantly reduce operational overheads by outsourcing maintenance and infrastructure responsibilities. However, it is not without its drawbacks; reliance on third-party services introduces a layer of risk regarding security and trustworthiness. Moreover, the profitability of cloud mining contracts can be ambiguous due to hidden fees and variable payout structures. In contrast, physical mining offers transparency in operations but demands substantial investment in both time and resources.

Moreover, when analyzing remote mining compared to on-site mining, we uncover distinct benefits and drawbacks associated with each method. Remote mining allows individuals to leverage specialized facilities designed for maximum efficiency while minimizing their personal involvement. This approach can yield impressive returns without the burdens of managing hardware directly. However, it also poses challenges such as reduced oversight and potential issues with service providers. On-site mining offers hands-on control and immediate access to equipment but comes with significant responsibilities related to maintenance, energy consumption, and environmental factors.

Ultimately, the choice between these various forms of mining–whether cloud-based or hardware-focused–depends on individual circumstances and priorities. Factors such as budget constraints, technical expertise, risk tolerance, and long-term goals should all be reviewed meticulously before committing to a specific strategy. Each option presents unique opportunities for profit generation while simultaneously carrying inherent risks that must not be overlooked.

In conclusion, both hardware mining and its alternatives present a complex landscape rife with potential rewards tempered by considerable challenges. As this space continues to evolve rapidly, understanding the nuanced differences between these methods will be crucial for informed decision-making. By carefully analyzing the strengths and weaknesses of each approach, prospective miners can navigate this labyrinthine environment more effectively, ensuring they are well-equipped to adapt to the volatile nature of cryptocurrency markets.