Choosing Your First Crypto Trading Platform

In an age where digital currencies have emerged as both a financial revolution and a cultural phenomenon, the allure of cryptocurrency trading beckons many newcomers. Yet, for those stepping into this complex realm, the vast array of platforms available can be as daunting as it is exciting. The question that often arises is: which platform is right for you? Understanding the basics of cryptocurrency trading and the nuances of various exchanges is essential for newbies embarking on this journey.

The landscape of cryptocurrency trading is rife with opportunities, but it also harbors pitfalls for the unprepared. Choosing the right platform becomes not just a matter of preference but a crucial decision that can significantly influence one’s trading experience. With numerous options available, each boasting unique features and varying degrees of user-friendliness, the challenge lies in discerning which exchange aligns best with your individual needs and trading aspirations.

This article serves as an introductory guide to cryptocurrency trading, specifically tailored for beginners. We will delve into the fundamental aspects of trading while exploring the best platforms suited for those just getting started. By focusing on key factors such as security, ease of use, and available resources, we aim to equip you with the knowledge necessary to make informed decisions when selecting your ideal crypto exchange.

As we embark on this exploration together, remember that every seasoned trader was once a beginner. With careful consideration and a willingness to learn, you too can navigate the intricate world of cryptocurrency trading with confidence. Let us begin this enlightening journey into the basics of crypto trading and discover which platform may be your perfect match.

Cryptocurrency Trading Platforms Explained

In the burgeoning world of cryptocurrency trading, beginners often find themselves at a crossroads when choosing the right platform to engage with. The landscape is peppered with a myriad of platforms, each boasting unique features and functionalities. For many newcomers, the sheer volume of options can be overwhelming. An introductory understanding of cryptocurrency trading platforms is essential for making informed decisions. It is not merely about selecting an exchange but about aligning that choice with one’s trading goals and preferences.

When embarking on this journey, it is crucial to comprehend the basics of how these platforms operate. Cryptocurrency exchanges function as intermediaries that facilitate the buying and selling of digital assets. They vary significantly in terms of user interface, security measures, transaction fees, and available cryptocurrencies for trading. As a beginner, one should prioritize user-friendly interfaces that offer educational resources, making the learning curve less steep and more manageable.

Getting started with crypto trading involves a few pivotal questions: Which exchange should you use? What features are essential for your needs? Popular exchanges like Coinbase, Binance, and Kraken cater to different types of users. For instance, Coinbase is often praised for its simplicity, making it an ideal starting point for newbies. Alternatively, Binance offers a broader range of coins and advanced trading options, appealing to those who may wish to dive deeper into the market as they gain experience.

Choosing the right platform also entails evaluating security measures. With the rise in popularity of cryptocurrency comes an increase in fraudulent activities targeting unsuspecting traders. Platforms that prioritize security will offer two-factor authentication, cold storage for funds, and a transparent policy regarding data protection. Beginners should be wary of exchanges lacking robust security protocols, as the risks associated with potential hacks can lead to significant losses.

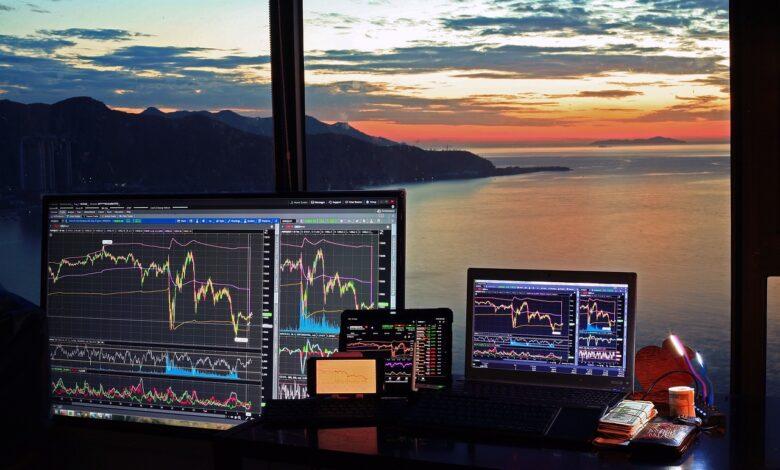

Understanding the basics of cryptocurrency trading goes beyond just selecting a platform; it involves familiarizing oneself with the various types of orders (like market orders and limit orders) and strategies (such as day trading versus holding). Many platforms provide demo accounts that allow users to practice trading without financial risk. This feature can be particularly beneficial for newbies looking to hone their skills before committing real capital.

In conclusion, navigating the complex world of cryptocurrency trading requires careful consideration and informed decision-making. By understanding the fundamental aspects of trading platforms–what they offer, how they operate, and their varying levels of complexity–beginners can confidently embark on their crypto trading journey. As one delves deeper into this exciting domain, choosing the right platform will serve as a cornerstone to successful trading practices and long-term engagement with cryptocurrencies.

Top Features of Trading Platforms: Getting Started with Crypto Trading

In the burgeoning world of cryptocurrency, choosing the right exchange is paramount for beginners who are eager to dive into trading. The plethora of platforms available can be overwhelming, yet understanding the essential features can facilitate a more informed decision. Key aspects such as user interface, security measures, trading fees, and customer support should be paramount in your evaluation process. A platform that combines an intuitive design with robust security protocols will not only enhance the trading experience but also instill a sense of confidence for newcomers.

For newbies looking to get started with crypto trading, it’s crucial to consider the variety of cryptocurrencies offered by different exchanges. Some platforms provide a limited selection, while others boast extensive listings that include altcoins and tokens beyond Bitcoin and Ethereum. A diverse array allows traders to explore various investment opportunities and hedge against market volatility. Additionally, consider whether the exchange supports fiat-to-crypto transactions; this is essential for beginners who may not yet hold any digital assets.

When embarking on your journey into cryptocurrency trading, understanding the basics is fundamental. Many platforms offer educational resources like tutorials, webinars, and demo accounts that can prove invaluable for those just starting out. These tools can help demystify trading strategies and market analysis, enabling users to gain confidence before committing real capital. Seek out platforms that place a strong emphasis on education, as they often foster a more supportive environment for new traders.

Choosing the right platform also involves evaluating transaction speeds and liquidity. High liquidity ensures that trades can be executed quickly at desired prices, which is particularly important in the highly volatile crypto market. A platform with sluggish processing times can lead to missed opportunities or unfavorable pricing. Thus, for beginners wishing to engage in active trading, selecting an exchange known for its liquidity is vital.

Furthermore, security measures cannot be overstated when considering which exchange to use. Beginners must scrutinize how a platform protects user data and funds. Look for features like two-factor authentication (2FA), cold storage options for cryptocurrencies, and transparent insurance policies that safeguard against potential breaches. A secure environment allows traders to focus on learning the intricacies of crypto trading without the looming anxiety of cyber threats.

Lastly, we must acknowledge the importance of community and customer support in your trading experience. Platforms that foster active communities often provide forums or social media groups where users can share insights and strategies. Coupled with responsive customer service channels, these elements contribute significantly to a positive trading environment for newbies navigating their first steps into cryptocurrency markets. In conclusion, understanding these fundamental aspects will empower beginners to select the best platform suited for their unique trading needs.

Choosing the Right Platform for You

When embarking on the journey of cryptocurrency trading, the first and perhaps most critical decision is choosing the right platform. Various exchanges are available, each presenting unique features that cater to beginners. It’s essential to understand what you aim to achieve with your trading activities. Are you looking for a user-friendly interface, low fees, or advanced trading tools? The right platform is one that aligns with your goals and provides an environment conducive to learning and growth.

Getting started with crypto trading requires an understanding of which exchange to use. The landscape of cryptocurrency platforms can be overwhelming for newbies; hence, it’s beneficial to focus on a few key attributes. Look for exchanges that offer robust security measures, responsive customer support, and a comprehensive selection of cryptocurrencies. Platforms like Coinbase or Binance are often recommended for beginners due to their intuitive interfaces and educational resources. However, it’s imperative to conduct personal research to identify which exchange resonates best with your individual needs.

Cryptocurrency trading basics encompass not only the mechanics of buying and selling but also the overarching framework of different platforms available for new traders. The best platforms for newbies typically include features such as demo accounts, tutorial videos, and community forums where users can share experiences. For example, Kraken offers an easy onboarding process alongside educational materials that demystify trading concepts. This supportive ecosystem can significantly enhance your confidence as you start navigating this complex financial arena.

In conclusion, an introduction to cryptocurrency trading necessitates a thoughtful approach to choosing the right platform. Each trader’s journey is unique, influenced by factors such as risk tolerance, investment goals, and prior experience in financial markets. By carefully evaluating exchanges based on their offerings and your personal aspirations, you can set a solid foundation for your trading endeavors. Remember that the world of crypto is dynamic; thus, maintaining flexibility in your choice will allow you to adapt as you gain more knowledge and experience.

Conclusion: Navigating the Crypto Trading Landscape

As we’ve explored throughout this discussion, the world of cryptocurrency trading is both exhilarating and daunting, especially for beginners. The basics of trading are not merely about understanding charts and graphs; they encompass a broader comprehension of the platforms available for use, the right strategies to adopt, and the common pitfalls to avoid. For newbies venturing into this digital realm, choosing the right exchange can often feel overwhelming amidst a plethora of options.

However, with a thoughtful approach, one can demystify this complex landscape. Whether you are drawn to user-friendly platforms designed specifically for beginners or more sophisticated exchanges that cater to seasoned traders, it’s imperative to choose wisely. Always remember that getting started with crypto trading requires a solid foundation built on knowledge, caution, and continuous learning.

- Understand the Basics: Familiarize yourself with key concepts in crypto trading.

- Choose the Right Platform: Assess which exchange aligns with your trading goals and skill level.

- Avoid Common Mistakes: Learn from others’ experiences–patience and diligence are your allies.

- Keep Educating Yourself: The crypto landscape evolves rapidly; staying informed is crucial.

In conclusion, as you embark on your cryptocurrency trading journey, let curiosity guide you. Embrace the learning process, leverage technology with prudence, and cultivate an awareness of market dynamics. With the right mindset and the best platforms at your disposal, you can navigate this fascinating digital frontier with confidence and purpose. Welcome to the evolution of finance–your adventure begins now!