Powering Profits – The Cost of Electricity in Mining

In the intricate landscape of cryptocurrency mining, where the allure of substantial revenue is often tempered by the harsh realities of operational expenses, one factor looms larger than most: electricity costs. These charges are not merely a footnote in the financial ledger; they represent a crucial element in determining overall profitability. As miners grapple with volatile market conditions and fluctuating coin values, understanding the implications of energy expenses becomes paramount for sustainable operations.

The relationship between power charges and mining profitability is as complex as it is critical. Energy expenses constitute a significant portion of the total operational costs, often eclipsing other factors in their impact on financial outcomes. For miners, every kilowatt-hour consumed translates into a direct effect on revenue; thus, optimizing electricity usage becomes an essential strategy for enhancing profitability. In this context, the choice of location–often dictated by local energy prices–emerges as an important determinant of success.

Furthermore, as technology evolves and mining hardware becomes increasingly sophisticated, the efficiency of energy consumption must remain a focal point. The delicate balance between power demands and computational output highlights why understanding electricity costs is not just an academic exercise but a key component in the ongoing endeavor to maximize returns. To navigate this challenging terrain successfully, miners must adopt a keen awareness of their energy expenses and actively seek ways to mitigate them, ensuring long-term viability in an ever-competitive market.

Electricity Costs in Crypto Mining: A Major Factor in Profitability

In the realm of cryptocurrency mining, electricity costs stand as a formidable barrier to profitability. The process of mining itself is energy-intensive, relying on vast amounts of electrical power to validate transactions and secure networks. These energy expenses are not merely incidental; rather, they constitute a significant component in the overall cost structure of mining operations. As miners grapple with fluctuating market values of cryptocurrencies, it becomes increasingly evident that managing electricity charges is paramount for sustaining a viable business model.

Electricity expenses serve as one of the most critical determinants of mining profitability. For instance, in regions where electricity is abundant and affordable, miners can operate at a competitive advantage, reaping higher margins from their efforts. Conversely, areas burdened by exorbitant power charges may find their operations economically unfeasible, leading to unsustainable losses. Understanding this relationship between energy costs and revenue is essential for any serious participant in the mining ecosystem.

Moreover, the dynamic nature of electricity prices exacerbates the challenge miners face. Power charges can fluctuate based on demand, regulatory changes, and even seasonal factors such as temperature variations that affect cooling needs for mining rigs. Therefore, miners must adopt strategies that consider these contingencies, often resulting in a constant battle to lower energy expenses while maximizing output. This reality underscores the importance of location selection; miners often relocate or invest in renewable energy sources to mitigate these unpredictable costs.

It is also crucial to acknowledge that electricity expenses are not uniform across the globe. For example, countries like China have historically offered subsidized rates for power, attracting countless miners to set up operations there. However, ongoing regulatory crackdowns have forced many to reconsider this advantage. In contrast, regions with high renewable energy resources–such as Iceland or certain parts of Canada–present an appealing alternative for miners seeking more stable and lower-cost energy solutions.

The implications of electricity costs extend beyond immediate profitability; they also shape the broader landscape of cryptocurrency mining. As environmental concerns rise and regulations tighten around carbon emissions, miners are increasingly seeking sustainable practices to reduce both their ecological footprint and their reliance on traditional power sources. Innovations in energy efficiency and investment in green technologies are becoming essential elements of a comprehensive strategy aimed at ensuring long-term viability within this rapidly evolving industry.

In conclusion, understanding electricity costs is vital for anyone involved in crypto mining. These expenses represent not only a key component of operational budgets but also a crucial factor influencing strategic decisions regarding location, technology adoption, and sustainability practices. As the cryptocurrency landscape continues to evolve, those who adeptly navigate the complexities of energy management will likely emerge as leaders in this competitive arena.

The Impact of Electricity on Mining Profitability

In the intricate web of cryptocurrency mining, electricity expenses stand out as a fundamental element that significantly influences profitability. As miners compete in an environment governed by complex algorithms and escalating difficulty levels, the costs associated with energy consumption emerge as a critical determinant of their overall revenue. In this context, understanding how power charges affect the bottom line is essential for both seasoned miners and newcomers to the industry.

Electricity is not merely an operational necessity; it is a key component in the mining equation. The efficiency of mining hardware, the geographical location of operations, and regional energy prices interact to create a multifaceted scenario where electricity costs can either bolster or undermine profitability. For instance, miners operating in areas with subsidized energy rates can achieve markedly higher margins compared to those in regions burdened by expensive power charges.

Moreover, fluctuations in electricity prices can have profound implications for mining revenue streams. A sudden spike in energy costs may render previously profitable operations unviable, forcing miners to reconsider their strategies or even halt operations altogether. Conversely, periods of lower energy expenses can lead to increased profitability, allowing miners to capitalize on favorable market conditions more effectively. This dynamic highlights the importance of continuous monitoring and strategic planning regarding energy procurement and consumption.

The crucial role of electricity expenses extends beyond mere cost considerations; it fundamentally shapes the landscape of mining profitability. For example, innovative approaches to energy sourcing–such as leveraging renewable energy solutions–can mitigate traditional power charges while enhancing sustainability. Miners who invest in solar or wind energy infrastructure not only reduce their exposure to volatile electricity markets but also position themselves favorably in a growing sector increasingly focused on environmental responsibility.

Furthermore, understanding the interplay between energy expenses and mining technology is vital for optimizing profitability. Advanced mining rigs designed for lower power consumption can dramatically alter the cost-benefit analysis for miners. By carefully selecting equipment that maximizes hash rates while minimizing electricity usage, operators can improve their profit margins significantly. This technological evolution underscores the necessity for miners to remain informed about both advancements in hardware and developments in energy markets.

In summary, electricity costs are an indispensable factor in determining the profitability of cryptocurrency mining operations. The ongoing challenge lies in navigating the complexities of global energy markets while maximizing operational efficiency and revenue potential. As the industry evolves, those who adeptly manage their electricity expenses will likely find themselves at a competitive advantage–reinforcing the notion that in the world of mining, knowledge truly is power.

Strategies to Reduce Electricity Expenses

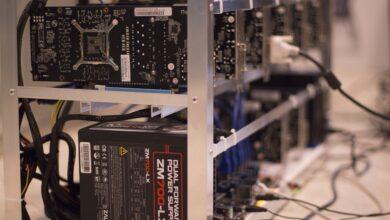

In the world of cryptocurrency mining, where profitability hinges on a multitude of factors, electricity expenses emerge as a critical component. The energy consumed by mining rigs is not just a minor detail; it constitutes a significant portion of overall operational costs. As miners grapple with fluctuating market values and increasing competition, understanding and optimizing power consumption becomes imperative. Implementing strategies such as utilizing renewable energy sources or negotiating better rates with local utilities can yield substantial savings, ultimately enhancing profitability.

Electricity expenses are not merely a line item in a budget; they act as a crucial determinant of mining revenue. The relationship between energy costs and potential earnings is intricate; high electricity charges can erode margins, making otherwise lucrative mining ventures unviable. Miners must be astute in their approach, often opting for geographical locations with cheaper electricity rates or investing in energy-efficient hardware. For instance, regions with abundant hydroelectric power offer favorable conditions for reducing expenses while maintaining competitive hashing power.

Moreover, energy expenses should be viewed through the lens of scalability and long-term sustainability. As the mining landscape evolves, the ability to adapt to rising power costs will be paramount. Incorporating energy management systems that monitor consumption in real-time can provide insights into usage patterns and highlight areas for improvement. Additionally, joining forces with other miners to form cooperatives could lead to collective bargaining power when negotiating energy charges, further mitigating the impact of high electricity costs on profitability.

Ultimately, power charges represent a fundamental element in the broader equation of mining economics. Their influence extends beyond mere cost considerations; they shape strategic decisions about equipment investments, operational efficiency, and market positioning. In an industry where margins are often razor-thin, recognizing electricity expenses as an essential factor can provide miners with a competitive edge. By prioritizing energy optimization and adopting innovative practices, miners not only safeguard their revenue but also contribute to the sustainable evolution of cryptocurrency mining as a whole.

Future Trends in Energy Costs and Their Impact on Mining Profitability

In the intricate world of cryptocurrency mining, the interplay between electricity costs and profitability stands as a monumental challenge. As miners navigate the relentless tides of market fluctuations, one cannot overlook how power charges emerge as a crucial element in determining overall revenue. The expenses associated with energy consumption are not mere figures on a balance sheet; they are vital components that shape the landscape of mining operations, influencing decisions from small-scale hobbyists to vast industrial enterprises.

As we peer into the future, it becomes increasingly evident that electricity expenses will remain a key determinant of mining profitability. With advancements in technology and shifts in regulatory frameworks, the strategies employed by miners must adapt accordingly. The rising importance of renewable energy sources presents both challenges and opportunities; harnessing these can lead to significant reductions in costs while enhancing sustainability–a dual victory in an industry often criticized for its environmental impact.

Conclusion: Navigating the Future of Mining Expenses

The path forward is fraught with complexities, yet there lies within it a rich tapestry of potential. The relationship between energy expenses and mining profitability is undeniable. Miners must embrace innovative solutions and remain vigilant regarding future trends in energy costs. By understanding the pivotal role that electricity plays as a component of operational expenses, stakeholders can make informed decisions that pave the way for sustained success.

- Key Takeaways:

- Electricity costs are a crucial determinant of mining revenue.

- Energy efficiency will be an important factor in reducing overall expenses.

- Adopting renewable energy sources can significantly enhance profitability.

- As technology progresses, so too must strategies for managing power charges.

Ultimately, the future of mining profitability hinges on our ability to adapt to changing energy landscapes while seizing opportunities for innovation. The journey ahead may be challenging, but with each calculated decision, miners can illuminate their path to success amidst the shadows of fluctuating costs.