Economic Forces Shaping Crypto Mining Strategies

In the complex landscape of cryptocurrency, where digital assets oscillate between promise and peril, the influence of economic factors on mining decisions cannot be overstated. The intricate interplay of financial conditions shapes not only the strategies employed by miners but also the very viability of their operations. As we delve into this topic, we must consider how fluctuations in energy costs, hardware prices, and regulatory environments can significantly impact the choices made by those who engage in the laborious process of crypto mining.

The relationship between economic conditions and cryptocurrency mining is multifaceted. When financial markets are buoyant, miners may find themselves in a position to invest in cutting-edge technology that enhances their efficiency. Conversely, during periods of economic downturn, the pressure to cut costs can lead to critical decisions about equipment, energy sources, and even geographic location. Understanding these dynamics allows us to appreciate why certain regions become hotspots for mining activity while others languish in obscurity.

Moreover, the strategic decisions made by miners are informed by a multitude of external influences–government policies that favor renewable energy sources can create favorable conditions for sustainable mining operations, while stringent regulations may stifle growth in less fortunate locales. These financial factors shape not just individual choices but also the broader landscape of cryptocurrency as a whole. In examining these elements, we uncover a narrative that reveals the profound impact of economic forces on the world of digital currencies.

Ultimately, a comprehensive understanding of how economic factors affect cryptocurrency mining strategies equips us with insights into future trends. As we navigate this evolving terrain, it becomes clear that decision-making within the realm of crypto mining is not merely a reflection of technological prowess; it is deeply rooted in an ever-changing economic framework that demands attention and analysis. Herein lies the beauty and complexity of cryptocurrency–a field where financial acuity meets technological innovation.

How Economic Factors Impact Mining

In the intricate ecosystem of cryptocurrency, economic factors play a pivotal role in shaping the mining landscape. The conditions under which mining operations are conducted can significantly influence the decisions made by miners. For instance, fluctuations in electricity prices, hardware costs, and overall market conditions directly impact the feasibility of mining different cryptocurrencies. A miner’s profitability hinges on these financial variables, as they dictate both the operational expenses and potential returns on investment.

One of the most critical economic influences on mining strategies is the cost of electricity. Given that mining requires substantial computational power, energy consumption becomes a primary concern for miners. Regions with lower electricity rates often see a surge in mining activity, compelling individuals and companies to establish operations in these areas to maximize their profit margins. Conversely, high energy costs can deter mining efforts, leading to a contraction in certain markets or even the exit of less efficient miners from the ecosystem.

Moreover, the price volatility of cryptocurrencies themselves adds another layer of complexity to mining decisions. Economic conditions that drive up the price of a specific coin can encourage miners to allocate more resources toward its production. For example, during bullish market phases, miners often increase their investment in advanced hardware and larger-scale operations to capitalize on heightened demand. However, in bearish conditions, when prices plummet, many miners may reassess their strategies and shift focus to more stable or profitable cryptocurrencies.

The overall state of the economy also affects access to capital for mining operations. In prosperous economic climates, financing options tend to be more favorable, allowing miners to invest in cutting-edge technology and expand their operations. Conversely, during economic downturns or periods of uncertainty, securing funding may become challenging. This lack of financial support can limit a miner’s ability to innovate or adapt to changing market conditions, ultimately affecting their competitiveness within the crypto space.

Furthermore, regulatory landscapes shaped by economic policies can have profound implications for cryptocurrency mining. Countries with favorable regulations may attract miners due to lower tax burdens and supportive infrastructure. Conversely, regions imposing stringent regulations or high taxes may discourage investment in mining activities. As regulatory frameworks continue to evolve globally, miners must remain agile and responsive to these changes, adjusting their strategies accordingly to mitigate risks associated with compliance and operational viability.

In conclusion, the interplay between economic factors and cryptocurrency mining cannot be overstated. From electricity costs and hardware investments to market volatility and regulatory environments, each element contributes significantly to shaping the decisions and strategies employed by miners. Understanding these influences is essential for anyone looking to navigate the complex world of cryptocurrency mining effectively. As economies continue to fluctuate and evolve, so too will the strategies that underpin successful mining ventures.

Cost of Energy and Profitability in Cryptocurrency Mining

The profitability of cryptocurrency mining is predominantly influenced by the cost of energy, a critical factor that dictates the financial viability of mining operations. As miners compete to solve complex mathematical problems, the energy consumed during this process forms the backbone of operational expenses. For instance, in regions where electricity costs are low, such as certain parts of China or Iceland, miners can achieve higher profit margins compared to those operating in areas with elevated energy costs. This disparity highlights how financial considerations surrounding energy prices can significantly impact decisions regarding the location and scale of mining activities.

Economic conditions play a pivotal role in shaping the landscape of cryptocurrency mining. During periods of economic downturn or instability, investors may be less inclined to allocate funds towards high-risk ventures like crypto mining. Conversely, in a thriving economy where capital is more accessible, there tends to be an increase in investments directed towards the acquisition of advanced mining hardware and infrastructure. These economic fluctuations not only affect individual miners but also influence larger mining pools and companies that operate on a global scale, adapting their strategies based on prevailing market conditions.

Various economic influences dictate the decision-making processes of cryptocurrency miners. For example, government regulations regarding taxation and energy usage can create significant barriers or incentives for miners. In jurisdictions where favorable policies are enacted–such as tax breaks for renewable energy use–miners are more likely to establish operations. Conversely, stringent regulations can deter investment and limit growth potential within the sector. Thus, understanding these economic conditions becomes essential for stakeholders looking to navigate the complexities associated with cryptocurrency mining.

Financial factors extend beyond just energy costs; they encompass a range of elements that affect mining strategies. The volatility of cryptocurrency prices also plays a critical role in shaping miner behavior. Miners must continuously assess whether the anticipated rewards from mining justify the initial investments and ongoing operational costs. For instance, when bitcoin prices soar, even costly energy sources may become economically viable due to heightened profitability. However, during market downturns, many miners might find themselves reevaluating their strategies or halting operations entirely.

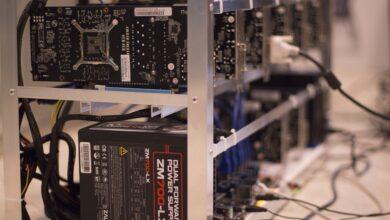

Moreover, the choice of mining equipment represents another crucial decision influenced by economic considerations. Advanced hardware often comes with high upfront costs but promises increased efficiency and lower energy consumption over time. Consequently, financial analyses must factor in both short-term expenses and long-term benefits to ascertain the best course of action. As technology evolves at a rapid pace within the crypto space, miners face continuous pressure to upgrade their equipment to remain competitive while balancing these financial implications.

In conclusion, the interplay between economic factors and cryptocurrency mining decisions reveals a complex web of influences that shape the industry’s future. From energy costs to market conditions and regulatory frameworks, each element plays a vital role in determining profitability and sustainability within this rapidly evolving sector. As financial landscapes shift and new technologies emerge, miners must stay attuned to these influences to make informed choices that will ultimately dictate their success in the volatile world of cryptocurrency mining.

Market Trends Affecting Choices

In the ever-evolving landscape of cryptocurrency, market trends play a pivotal role in shaping the choices made by miners. As the price of various cryptocurrencies fluctuates, so too do the dynamics of mining operations. For instance, during bullish periods, when prices surge, there is a notable increase in mining activities as profitability rises. Conversely, during bearish phases, miners may reassess their strategies, often leading to a decline in hash rates and an eventual consolidation of resources. This cyclical behavior highlights the profound influence that market conditions exert on mining decisions, compelling participants to adapt swiftly to maximize their returns while mitigating risks.

Financial Factors Affecting Crypto Mining Strategies

Financial aspects are integral to the formulation of cryptocurrency mining strategies. The initial capital investment required for hardware and infrastructure can be daunting; thus, miners must carefully evaluate their financial stability and potential return on investment (ROI). Factors such as electricity costs significantly impact profitability; for example, regions with lower energy expenses often become hotspots for mining operations. Additionally, fluctuations in cryptocurrency valuations necessitate ongoing financial analysis, prompting miners to diversify their portfolios or pivot towards more stable assets. Consequently, the interplay between financial factors and strategic planning underscores the necessity of informed decision-making in a volatile market.

Impact of Economic Conditions on Mining Cryptocurrency

Economic conditions serve as both a backdrop and a catalyst for cryptocurrency mining endeavors. Factors such as inflation rates, currency stability, and overall economic growth can directly influence miners’ operational viability. In economies facing high inflation or currency depreciation, cryptocurrencies may be perceived as a hedge against traditional financial systems, driving increased demand and subsequently impacting mining activities. Furthermore, global economic conditions can lead to shifts in investment trends; during times of economic uncertainty, investors may flock to cryptocurrencies as alternative assets, influencing miners to adjust their output in response to changing market demands.

Economic Influences on Cryptocurrency Mining Decisions

The decisions made by cryptocurrency miners are invariably shaped by broader economic influences. Regulatory changes, for instance, can alter the landscape dramatically; jurisdictions that impose stringent regulations may deter mining operations, while those fostering innovation can attract significant investments. Moreover, access to technology and skilled labor is often dictated by local economic conditions, affecting the efficiency and competitiveness of mining efforts. As these multifaceted economic influences converge, they create an intricate web that miners must navigate. Ultimately, successful navigation of these factors requires not only an understanding of market dynamics but also a keen awareness of the underlying economic principles that govern them.