How to Sell Your Mining Hashpower

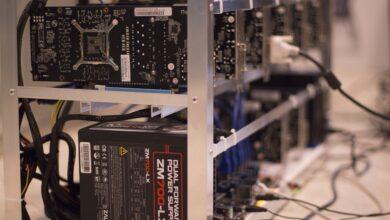

Your mining rig’s computational power represents a direct revenue stream, and letting it sit idle during market dips is a missed financial opportunity. Instead of solely mining a single coin, you can sell your hashpower to a third party. This model, often called renting or a lease, involves connecting your hardware to a marketplace that matches sellers with buyers who need raw hashrate for specific projects. The immediate benefit is converting your fixed asset–your mining hardware–into a flexible instrument for consistent earnings, regardless of a particular coin’s price volatility.

The core mechanism for monetizing your rigs involves specialised pool protocols. Platforms like NiceHash or Mining Rig Rentals act as intermediaries; you point your machines at their stratum servers using a unique worker ID, and they handle the selling of your power to the highest bidder. Buyers typically use this rented hashpower for short-term speculative mining on emerging coins or to secure smaller networks. Your profit is calculated based on the accepted bids for your hashrate, often paid out in Bitcoin for simplicity, providing a stabilising effect on your income.

Maximising returns requires a data-driven approach to platform selection and hardware management. Analyse the 30-day average profitability for your specific GPU or ASIC models across different services–this data is publicly available and can reveal a 5-15% variance in daily earnings. For instance, a rig generating 2 GH/s on Ethash might earn £45 on a direct mining pool but could fetch the equivalent of £48-£52 through a strategic lease during peak buying hours. The key is to treat your hashpower as a commodity, actively switching between direct mining and renting based on real-time market demand to optimise your annualised return on investment.

Choosing a Mining Marketplace

Select a marketplace that supports your specific hardware algorithm. Renting out SHA-256 hashpower from an Antminer S19 requires a different platform than one designed for selling the computational power of a GPU rig on RandomX. Marketplaces like NiceHash act as an all-in-one pool, while others like Hive OS’s marketplace connect you directly to buyers seeking to lease specific hashrate. Your profit depends on this fundamental compatibility.

Fee Structures and Payment Transparency

Scrutinise the fee model before you commit. A platform might advertise a 1% pool fee but add a 3% service charge for withdrawals, directly cutting into your profit. Look for transparent, all-inclusive fee percentages. Compare the payout frequency and minimum withdrawal thresholds; some platforms settle daily, while others operate on a weekly schedule, affecting your cash flow. Your goal is to monetize your hashrate, not fund excessive operational overhead.

Security and Reputation

Your mining power is a valuable asset; don’t sell it out on a dubious platform. Research the company’s history, looking for evidence of consistent payouts and responsive support. Established marketplaces have user reviews and public-facing statistics on their total rented hashrate. Avoid platforms that require you to deposit funds to start selling; your interaction should be one-way–you provide computational power and receive payment. A secure lease agreement is built on trust and verifiable data.

Setting Your Rental Price

Set your price by calculating your operational break-even point, then adding a margin. For example, if your rig consumes 3kW at £0.34 per kWh, your daily electricity cost is £24.48. Divide this by your hashrate; a 1 GH/s unit means your base cost is £0.00002448 per MH/s per day. A 15-25% margin on top creates your minimum viable rent. Charging less means you are effectively leasing your hardware at a loss.

Monitor your target mining pool’s marketplace for 48-72 hours to gauge real-time demand. If the average asking price for your algorithm is £0.000035 per MH/s, but listings sit unfilled, price yours at £0.000033 to attract immediate contracts. This strategy of undercutting the market by 5-10% accelerates monetizing your idle hashpower, turning potential profit into actual earnings faster than holding out for a premium.

Your computational power is a perishable asset; every hour it isn’t mining or rented, its value expires. Factor in network difficulty forecasts. If a 10% increase is expected, your hashpower becomes more valuable. Adjust your selling price upward pre-emptively by a similar percentage. Renting out your rigs is not just about immediate profit, but about maximising long-term earnings by anticipating market shifts that a lessee will pay for today.

Managing Payouts and Security

Set your payout threshold on the marketplace to match your cash flow needs; a lower threshold of 0.001 BTC improves liquidity but increases transaction fee overhead, while a higher threshold of 0.01 BTC consolidates earnings but delays access to your profit. Your choice directly impacts your operational budget for electricity costs, a non-negotiable expense when selling computational power.

Securing Your Earnings

Never leave accumulated funds on a marketplace wallet. The moment your balance clears the platform’s withdrawal minimum, transfer it to your private, cold storage. Marketplaces are hot wallets by nature and represent a concentrated risk; your profit is only truly yours once it’s in a wallet where you control the private keys. Treat the process of renting out your hashrate with the same security rigour as running your mining pool.

Diversify your monetizing strategy by leasing portions of your hashpower on different platforms or for varying contract lengths. This mitigates the risk of a single marketplace experiencing downtime or a sudden drop in rental demand, ensuring a more consistent income stream from your hardware.

Scrutinise the smart contract details for any rent or lease agreement. Reputable platforms use audited, non-custodial contracts that automatically route earnings to your designated wallet, minimising counterparty risk. Your computational power is the asset; the contract is your shield, ensuring you are paid for every megahash sold.