Mining Mechanisms – PoW vs. PoS Explained

In the ever-evolving landscape of cryptocurrency, two predominant mechanisms have emerged to validate transactions and secure networks: Proof of Work (PoW) and Proof of Stake (PoS). These mining mechanisms serve as the backbone of blockchain technology, each offering distinct advantages and challenges. As we embark on this analytical journey, we will delve into the intricacies of these systems, highlighting their fundamental differences and the implications they hold for the future of digital currency.

At its core, understanding the mechanisms of mining is essential for anyone seeking to navigate the complex world of cryptocurrencies. Proof of Work, the older of the two models, relies on computational power to solve intricate mathematical problems, thereby securing the network through a process that demands significant energy consumption. On the other hand, Proof of Stake introduces a more environmentally friendly approach by allowing validators to create new blocks based on their stake in the network, fundamentally altering the dynamics of how transactions are confirmed and blocks are added.

As we analyze these mechanisms, it becomes crucial to grasp not only their operational differences but also their impact on decentralization, security, and scalability. The debate between PoW and PoS is not merely academic; it reflects deeper philosophical questions about resource allocation, economic incentives, and the sustainability of blockchain technologies. By comprehending these two paradigms, we can better appreciate their roles within the broader context of cryptocurrency mining and understand how they shape our digital future.

Understanding Proof of Work vs. Proof of Stake in Cryptocurrency Mining

In the realm of cryptocurrency, two prominent mechanisms stand out when discussing the validation and security of transactions: Proof of Work (PoW) and Proof of Stake (PoS). Analyzing these mechanisms reveals fundamental differences that shape not only how cryptocurrencies are mined but also their long-term sustainability and environmental impact. At its core, understanding the intricacies of these systems is crucial for anyone involved in or contemplating investment in digital currencies.

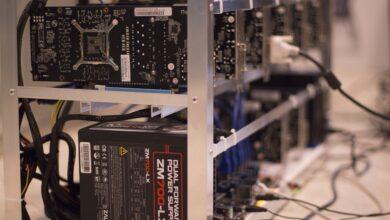

Proof of Work operates on a principle that mandates miners to solve complex mathematical puzzles to validate transactions and create new blocks on the blockchain. This process requires considerable computational power and energy consumption. The concept is akin to a competitive race where miners vie to be the first to complete a puzzle, thereby earning rewards in the form of cryptocurrency. While this mechanism has proven its efficacy in securing networks, such as Bitcoin, it has drawn criticism for its heavy reliance on energy resources, raising questions about environmental sustainability.

In contrast, Proof of Stake offers a different approach to mining, one that significantly reduces energy consumption by selecting validators based on the number of coins they hold and are willing to “stake” as collateral. Essentially, this means that the probability of creating a new block is proportional to the amount of cryptocurrency held by a participant. This mechanism not only mitigates the environmental concerns associated with PoW but also introduces an element of economic stability, as those with substantial stakes have a vested interest in maintaining the integrity of the network.

Comprehending the differences between these two mining mechanisms involves recognizing how they influence the decentralization and security of networks. PoW tends to favor those with greater resources, leading to potential centralization around mining pools. Conversely, PoS encourages broader participation since it does not require significant investments in hardware. This democratization fosters a diverse range of stakeholders who contribute to network security while potentially reducing barriers to entry for new participants.

Moreover, analyzing real-world applications sheds light on the ongoing evolution within the cryptocurrency space. Ethereum, for instance, is transitioning from a PoW model to PoS through its Ethereum 2.0 upgrade. This shift underscores an increasing recognition among developers and users alike of the need for more sustainable practices in cryptocurrency mining. By embracing PoS, projects aim to balance efficiency with ecological responsibility, aligning technological advancement with broader societal values.

Ultimately, understanding these mechanisms–Proof of Work vs. Proof of Stake–is essential for grasping the future trajectory of cryptocurrency mining. As debates continue over which system is superior, it becomes evident that both approaches possess unique advantages and disadvantages. The challenge lies not merely in choosing between them but in fostering innovation that reconciles their differences while promoting a more sustainable cryptocurrency ecosystem for generations to come.

Understanding Proof of Work vs. Proof of Stake in Mining

In the realm of cryptocurrency, the mechanisms that underpin the validation and security of transactions are pivotal to their functionality. One such mechanism is Proof of Work (PoW), which serves as a foundational element for many cryptocurrencies, most notably Bitcoin. In PoW, miners engage in a competitive process where they solve complex mathematical problems to validate transactions and create new blocks in the blockchain. This process requires significant computational power and energy consumption, as miners must invest in specialized hardware to remain competitive. The successful miner receives a block reward, thus incentivizing continued participation in this resource-intensive endeavor.

Grasping the differences between Proof of Work and its counterpart, Proof of Stake (PoS), is essential for anyone delving into the world of cryptocurrency mining. While PoW relies on computational effort to secure the network, PoS shifts this paradigm by enabling validators to create new blocks based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This not only reduces the energy consumption associated with mining but also allows for greater scalability. As such, understanding these fundamental differences can provide insight into the evolving landscape of blockchain technology and its implications for environmental sustainability.

Analyzing mining mechanisms reveals a complex interplay between security, decentralization, and economic incentives. In PoW, the requirement for extensive computational resources can lead to centralization, as only those with access to substantial capital can afford the necessary equipment. Conversely, PoS posits that wealth accumulation can facilitate participation without necessitating vast energy expenditures. This distinction is critical in determining how cryptocurrencies evolve and adapt to challenges such as network congestion and transaction fees.

Comprehending Proof of Work and Proof of Stake also involves recognizing their respective vulnerabilities. PoW systems are susceptible to 51% attacks, wherein an entity gains control over a majority of the mining power, potentially allowing them to manipulate transactions. On the other hand, PoS systems face concerns regarding wealth concentration; if a small number of stakeholders hold a majority of coins, they may unduly influence network governance. Therefore, both mechanisms present unique challenges that developers must navigate when designing resilient blockchain systems.

Moreover, the debate surrounding these two mechanisms often extends beyond technical specifications into philosophical realms concerning fairness and accessibility. Proponents of PoW argue that it democratizes mining by allowing anyone with sufficient resources to participate, while critics highlight its environmental impact due to high energy consumption. In contrast, supporters of PoS commend its efficiency but caution against potential oligarchic tendencies as wealth translates directly into voting power within the network.

Ultimately, understanding Proof of Work versus Proof of Stake is not merely an academic exercise; it is vital for the future trajectory of cryptocurrency mining and blockchain technology at large. As we continue to witness advancements in both mechanisms, it becomes increasingly important for stakeholders–whether they be miners, investors, or casual users–to engage with these concepts critically. By doing so, we position ourselves to make informed decisions in an ever-evolving digital economy where innovation continually reshapes our understanding of value and security.

Benefits of Proof of Work: Analyzing Mining Mechanisms

In the intricate world of cryptocurrency, understanding the mechanisms that underlie mining is essential for grasping the broader implications of digital currencies. Proof of Work (PoW) stands as a foundational mechanism designed to secure networks and validate transactions. Its primary benefit lies in its robustness against attacks; the sheer computational power required to alter any part of the blockchain makes it a daunting task for potential adversaries. By requiring miners to solve complex mathematical problems, PoW not only ensures the integrity of the network but also incentivizes honest participation through rewards, thereby fostering a decentralized environment.

On the other hand, when analyzing mining mechanisms, one inevitably encounters Proof of Stake (PoS), an alternative that has gained traction due to its perceived efficiency and lower energy consumption. However, understanding the differences between these two systems reveals critical nuances. While PoW relies on computational effort and energy expenditure, PoS depends on the number of coins held by a user–essentially turning wealth into influence. This fundamental distinction raises questions about fairness and accessibility in the mining process, particularly in an era where environmental concerns are increasingly at the forefront of public discourse.

Grasping the differences between Proof of Work and Proof of Stake requires a deep dive into their operational frameworks. PoW’s reliance on hardware means that it often favors those with access to advanced technology and substantial financial resources, potentially creating a barrier to entry for smaller participants. In contrast, PoS democratizes this aspect by allowing users with varying amounts of cryptocurrency to participate in network validation. Yet, this system is not without its criticisms; concerns about centralization arise when large holders dominate staking pools, thereby diluting the very decentralization that cryptocurrencies strive to achieve.

In conclusion, comprehending both Proof of Work and Proof of Stake in cryptocurrency mining is vital for anyone engaged in this rapidly evolving field. Each mechanism presents unique advantages and disadvantages that reflect broader philosophical debates about decentralization, security, and environmental sustainability. As we continue to explore these mining methodologies, it becomes evident that neither system is inherently superior; rather, they each serve distinct purposes within the diverse landscape of cryptocurrency ecosystems. Understanding these mechanisms will empower participants to make informed decisions in an ever-changing digital economy.

Exploring Proof of Stake vs. Proof of Work in Cryptocurrency Mining

In the intricate world of cryptocurrency, the mechanisms that underpin how transactions are verified and added to the blockchain are pivotal. Two of the most prominent systems in this context are Proof of Work (PoW) and Proof of Stake (PoS). Understanding these mechanisms is essential for grasping the fundamental differences that dictate the efficiency, security, and sustainability of various cryptocurrencies. While PoW relies on computational power and energy consumption to validate transactions, PoS takes a markedly different approach by assigning validation rights based on the quantity of cryptocurrency held by a participant.

The crux of Proof of Work lies in its mining process, where individuals known as miners compete to solve complex mathematical puzzles. This competition requires significant computational resources, which translates into substantial energy consumption. The miner who first solves the puzzle gets to add a new block to the blockchain and is rewarded with cryptocurrency. This mechanism, while effective in securing the network against attacks, has drawn criticism for its environmental impact and high operational costs. As concerns about energy consumption grow, understanding the limitations of PoW becomes increasingly relevant.

In contrast, Proof of Stake introduces a more eco-friendly alternative by allowing users to validate transactions based on their stake in the cryptocurrency. Instead of competing through resource-intensive calculations, validators are chosen algorithmically, proportional to the amount they hold and are willing to “stake.” This method not only reduces energy consumption significantly but also encourages long-term investment in the cryptocurrency ecosystem. By comprehending how PoS operates, one can appreciate its potential advantages over PoW, especially in terms of scalability and sustainability.

Analyzing these two mechanisms reveals profound differences beyond just energy consumption. For instance, in PoW systems like Bitcoin, a small number of miners with substantial resources can dominate the network, leading to centralization concerns. On the other hand, PoS aims to distribute power more evenly among participants, as anyone with sufficient coins can become a validator. This shift promotes decentralization and community involvement while minimizing barriers to entry for new participants.

Furthermore, understanding the implications of these mechanisms extends into economic considerations. PoW often leads to inflationary pressures due to constant mining rewards needed to incentivize miners. Conversely, PoS can create deflationary dynamics if staking rewards are structured effectively. In both cases, comprehending the economic models behind these systems is vital for investors and stakeholders aiming to navigate the rapidly evolving landscape of cryptocurrency.

Ultimately, as we delve deeper into both Proof of Work and Proof of Stake, it becomes clear that each mechanism presents unique advantages and challenges. Grasping these differences is not just an academic exercise; it is essential for anyone looking to engage meaningfully with cryptocurrencies today. As technology continues to evolve and adapt, so too must our understanding of these foundational concepts that shape the future of digital finance.

Understanding Proof of Stake: Analyzing the Differences Between Proof of Work and Proof of Stake

In the ever-evolving landscape of cryptocurrency, grasping the nuances between different consensus mechanisms is crucial for anyone seeking to comprehend how digital currencies function. One of the most prominent systems is Proof of Stake (PoS), which contrasts sharply with its predecessor, Proof of Work (PoW). At its core, PoS operates on the principle that the creator of the next block is chosen in a deterministic way, depending on the number of coins they hold and are willing to “stake” as collateral. This fundamental shift from the energy-intensive mining process of PoW to a more economical and environmentally friendly approach marks a significant evolution in blockchain technology.

Analyzing the mechanisms underlying both PoW and PoS reveals essential differences in how transactions are validated and blocks are added to the blockchain. In Proof of Work, miners compete against each other to solve complex mathematical puzzles, consuming substantial amounts of computational power–and therefore energy–in the process. This not only raises concerns about environmental sustainability but also leads to centralization, as only those with access to high-powered machines can effectively participate in mining. Conversely, Proof of Stake mitigates this issue by allowing validators to create new blocks based on their stake in the network, thus democratizing participation and reducing the carbon footprint associated with cryptocurrency mining.

Comprehending these differences extends beyond merely understanding how each mechanism operates; it requires an examination of their respective strengths and weaknesses. Proof of Work has been lauded for its security features, as altering any aspect of the blockchain would necessitate overwhelming computational power. However, this very feature can also lead to vulnerabilities such as 51% attacks if a single entity controls a majority of mining power. On the other hand, while Proof of Stake offers a more energy-efficient alternative, it raises concerns about wealth concentration, where individuals with substantial holdings could disproportionately influence network decisions, potentially leading to oligarchic structures within decentralized ecosystems.

In addition to security implications, one must also consider the economic incentives that drive participants in each system. In Proof of Work, miners are rewarded with newly minted coins for solving puzzles and validating transactions, which can create volatility in supply and demand dynamics. Meanwhile, staking rewards in Proof of Stake systems typically come from transaction fees or newly created coins distributed proportionally to holders based on their stake. This creates different economic models that can affect user behavior and network stability over time.

Ultimately, understanding and analyzing these mechanisms–Proof of Work vs. Proof of Stake–is essential for anyone looking to navigate the complexities of cryptocurrency mining and investment. As blockchain technology continues to mature and innovate, it remains imperative for stakeholders to stay informed about these consensus models. The decisions made today regarding which mechanism to adopt will significantly influence not only individual investments but also the broader ecosystem’s sustainability and decentralization in the years to come.