Using Grid Trading Bots for Automated Earnings

Deploy a grid trading bot within a defined price range, such as £20,000 to £25,000 for Bitcoin, and let its algorithmic precision execute a pre-set set of orders. This creates a structured, mechanical system that capitalises on market fluctuations without requiring constant manual intervention. The core principle is simple but powerful: the bot places a series of buy and sell orders at fixed intervals, creating a ‘grid’ across the chosen price spectrum. As the asset’s price oscillates, the system automatically triggers these orders, capturing small, frequent profits from each minor price movement.

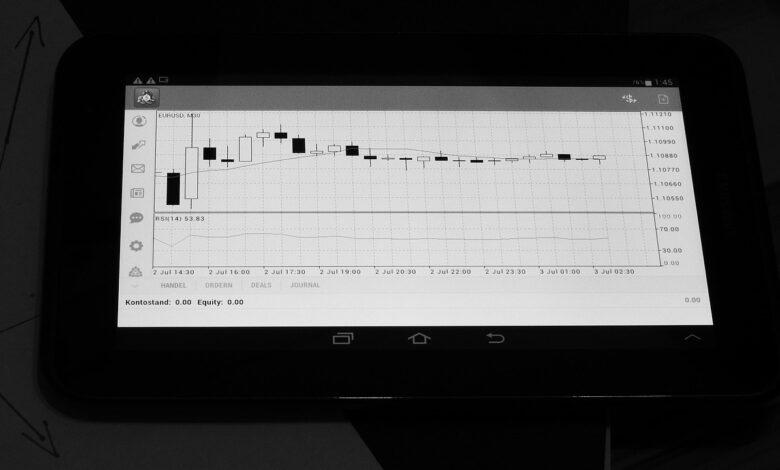

The primary advantage of these automated systems is the generation of a passive income stream. Unlike discretionary trading, which relies on emotional decision-making, grid bots operate on pure logic, removing psychological bias from the equation. This automation is particularly effective in sideways or consolidating markets where directional momentum is absent. For instance, a backtested strategy on a major forex pair like GBP/USD might show hundreds of micro-trades executed over a month, transforming periods of low volatility into consistent earnings.

However, successful implementation demands rigorous, data-driven analysis. A common failure point is deploying a grid during a strong, sustained trend without a safety mechanism. A 2022 study of common grid strategies highlighted that a 15% adverse move against the grid’s position could erase months of accumulated profit. My own analysis for UK-based traders involves correlating grid density with the average true range (ATR) of the asset and setting a maximum drawdown threshold. The most robust automated systems integrate a stop-loss for the entire grid, not just individual orders, preserving capital for future strategies.

Choosing Grid Bot Parameters

Set your grid’s upper and lower bounds using the asset’s 30-day Average True Range (ATR). For a market like BTC/GBP, a grid spanning from 5% below to 5% above the current price often captures sufficient volatility without overextending. A range tighter than 2% risks the price escaping the grid during normal fluctuations, turning your active bot into a passive, non-earning holder. The goal is to keep the mechanical systems operating within their designed parameters for consistent, algorithmic income.

Grid Density and Order Placement

Density dictates frequency. More grids mean more, smaller profit opportunities. For a £1000 allocation on a £20,000 asset, 20 grids placed every 0.5% can generate frequent, small earnings. However, this increases transaction cost drag. With UK exchange fees around 0.1% per trade, a bot executing hundreds of micro-trades can see a significant portion of its gross profit eroded. A sparser grid of 10 orders at 1% intervals reduces fee exposure but may miss shorter-term price oscillations. Analyse the historical bid-ask spread and your broker’s fee structure to find the equilibrium where automation works for you, not against you.

Allocation and Risk Per Trade

Never allocate more than 5% of your total portfolio to a single grid bot strategy. This is non-negotiable for sustainable earnings. Within the bot, the initial order size should be calculated based on the maximum acceptable drawdown. If your grid has 25 levels, and you risk £500, each buy order should be roughly £20. This disciplined, mechanical approach prevents emotional over-investment during a downtrend. The bot’s strength is its unemotional execution; your strength is in setting parameters that define its risk appetite, protecting your capital from large, single losses while pursuing passive profit.

Backtest your chosen parameters against at least three distinct market phases: a trending bull market, a ranging market, and a volatile downtrend. A configuration that shows steady earnings in a sideways market might generate significant, unrealised losses in a strong downtrend as it accumulates an oversized position. The most robust strategies are those that limit downside capture while maximising the number of completed grid cycles. Your bot’s profit is not just from upward moves, but from the repeated, algorithmic harvesting of volatility within its defined box.

Setting Stop-Loss and Take-Profit

Anchor your grid bot’s entire operation to a hard stop-loss, set at a 15-20% drawdown from your initial capital. This isn’t a discretionary guideline; it’s a non-negotiable circuit breaker. The mechanical nature of grid trading can create a false sense of security as the bot places orders during a downtrend. Without a definitive exit, you’re not averaging down–you’re escalating risk. The automation handles the grid, but you must define its failure point. For a £2,000 deployment, a 20% stop-loss caps your maximum loss at £400, protecting your capital for other strategies.

Defining Profit Realisation

While the bot generates small, frequent profits from volatility, a take-profit target secures your earnings from the overall position. Set this based on the asset’s volatility; for a stable crypto like BTC, a 5-7% net profit target is realistic, whereas for a more volatile altcoin, 10-15% may be appropriate. This prevents a mean-reverting market from erasing all accumulated gains. Your algorithmic system works tirelessly to create passive income, but the take-profit order is what actually banks it, transforming paper profits into realised earnings.

The synergy between these orders defines the bot’s risk-reward profile. A tight stop-loss with a wide take-profit is inherently unbalanced for a range-bound grid strategy. Instead, align them. A 15% stop-loss guarding an 8% take-profit provides a favourable asymmetry. This disciplined framework is what separates a speculative gamble from a structured, automated trading approach. The mechanical execution of the grid is useless without the strategic oversight of its boundaries.

Backtesting Your Grid Strategy

Run your grid bot’s logic against at least one full market cycle–a bull run and a subsequent bear phase–using historical data. I use a minimum of two years of hourly price data for my primary analysis. The goal isn’t to find a perfect, mythical setup, but to identify a configuration that would have remained profitable and within your risk tolerance during periods like the 2021 crypto winter or the March 2020 volatility spike.

Key Metrics to Scrutinise in Your Backtest Report

Your backtesting platform will generate a report; ignore the headline ‘Total Profit’ and focus on these specific data points:

- Maximum Drawdown (MDD): This is the largest peak-to-trough decline in your equity curve. A 25% MDD means you would have watched a quarter of your capital evaporate before recovery. For a supposedly passive income system, this is your most critical stress test.

- Sharpe Ratio: This measures your risk-adjusted return. A ratio above 1 is acceptable, above 2 is good, and it tells you if your earnings are coming from smart automation or simply from taking on excessive risk.

- Profit Factor (Gross Profit / Gross Loss): Aim for a value consistently above 1.2. A strategy with a 1.05 factor is likely too fragile and will be wiped out by trading fees and spread costs in live markets.

A Practical Case: The Volatility Trap

Many traders backtest a tight grid on a high-volatility asset like AVAX or ETH and see phenomenal paper profit. The mechanical systems appear to be earning constantly. However, the backtest often hides the reality of ‘grid collapse’.

- A strong, sustained trend moves the price far outside your grid’s upper or lower boundary.

- The bot stops placing new orders, leaving all your capital allocated to one side of the grid (e.g., all in a long position that is now deep in the red).

- Your passive income strategy has now become a high-risk, unhedged directional bet.

Your backtest must specifically check for these events. Filter the data to see performance only during strong trending months. If the strategy shows a 40% drawdown during those periods, you know its major weakness and can adjust the grid width or asset choice accordingly. This turns a theoretical automation into a robust, data-informed mechanical system.